At the heart of Class Valuation’s Digital Appraisal and Alternate Valuation products lies in the Property Data Advantage report. Designed for Uniform Property Dataset (UPD) collection, this flexible solution streamlines the data collection and delivery process, ensuring you have the most accurate and timely property information.

The Property Data Advantage report allows lenders to effortlessly participate in both Fannie Mae and Freddie Mac programs. With one simple order process, you can submit an order that meets the requirements of both agencies, simplifying your workflow and reducing turn times.

Submit your data to Fannie Mae and Freddie Mac with ease. The Property Data Advantage report ensures compliance and compatibility, making your lending process more efficient.

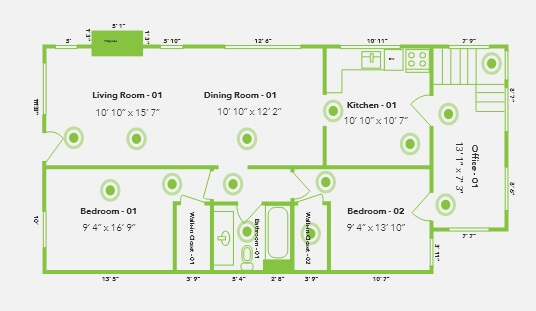

Receive a detailed report that covers the property’s condition with thorough interior and exterior views. Our meticulous data collection process provides you with a complete picture of the property, aiding in accurate assessment and decision-making.

Our efficient data collection process is completed in just a few hours, with the comprehensive Property Data Advantage report available within 24 hours. This rapid turn time helps you make faster decisions and move forward with confidence.

Accuracy is at the core of our data collection process. Our advanced tools and experienced professionals ensure that the information you receive is precise and reliable, supporting your appraisal and valuation needs.

By organizing our appraiser panel into performance-based tiers, we’re able to achieve far better results. The top 20% of our Class Act Panel completes nearly two-thirds of all of our orders.

Streamlined order process that saves time and resources.

A solution that adapts to your needs, providing a unified dataset for multiple programs.

Trustworthy and accurate data that supports your lending decisions.

Quick data collection and report delivery to keep your processes moving smoothly.

Visually capturing the details of a property has never been easier than with INvision Capture®. This easy-to-use mobile app pairs with imaging technology that makes it possible for property data collectors to collect property imaging down to the smallest details – both inside and out.

Get full, true-to-life perspective through interactive tours of the entire property. Zoom in for a closer look at the details, or zoom out for the bigger picture.

Expect the most precise measurements for the most precise valuations.

Leverage advanced digital replicas of the property to speed transactions while ensuring accuracy.

Since the launch of Property Fingerprint in 2019, Class Valuation has been a leading producer of property data collections through hybrid, desktop, and other modern appraisal programs. With a rapidly growing network of nearly 1,000 thoroughly vetted and background-checked data capture specialists, Class is able to provide 96% coverage nationwide.

Interested to learn how we can seamlessly enable you to be up and running with either Fannie Mae's Value Acceptance + Property Data program and Freddie Mac's ACE+ PDR solution? Fill out the form and we'll follow up with more information.

For any concerns regarding an Appraiser Independence issue please reach out to us via email at air@classvaluation.com or give us a call at 248.955.9506.

For any concerns regarding an Property Data Collector Independence issue please reach out to us via email at pdcir@classvaluation.com or give us a call at 248.509.0231.

ClassValuation © 2024