In 2018, the GSEs changed policy to allow Airbnb, VRBO, Vacasa, etc (also known as “Short-Term Rentals” or “STRs”) hosts to claim STR income as part of the Borrower Qualifications side of the lending decision. However, the GSEs did not make a parallel change to the Property Qualification side of the lending decision. While STR Income is allowed on the Borrower's income statement, the Market Rents for the collateral still needed to be based on longer-term leases. This imbalance in the lending equation has created the situation we find ourselves in today. Borrowers can take advantage of the superior STR income on one side and are denied that advantage on the other side. This is creating significant friction in the lending environment.

The purchase of real property for the purpose of investment is not new. Some transactions are considered long-term investments, to live in it and accrue equity. In other cases, we purchase a home for its income potential, renting the property to a tenant. In either case, the focus is on providing affordable housing to residents consistent with the GSE policies.

With the introduction of STRs it presents a profitable opportunity for investors of all kinds. The number of short-term rentals has increased exponentially over the last several years, and in some markets, investors are generating significant revenue; even on just one property.

Those investors (borrowers) are going to want to seek financing for the purchase transaction or to support a refinance.

Qualifying for a conventional mortgage on one of these properties is a challenge and without a tenant in place or proof of income, most lenders won’t even consider financing the investment property.

What does this mean for appraisers?

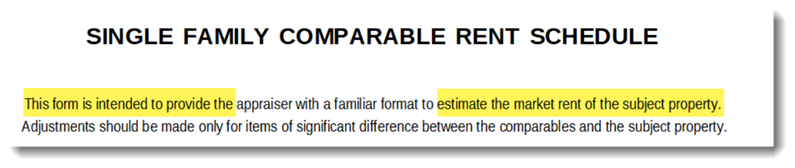

Our Lender/Clients will be looking for an appraisal to secure a loan on the STR; this is often considered a Debt Service Coverage Ratio (DSCR) Loan. These loans are generally High-Interest Rates, Adjustable Rates, Short Terms, Limited Locations, etc. The request will include the 1007 Rent Comparable Schedule and the request from the broker, agent, borrower, and even directly from the Lender/Client will be to utilize short-term rentals as comparables to develop an opinion of “Market Rent.”

There are plenty of financing options made with rental property investors in mind.

STRs are considered a high-risk loan compared to properties with long-term leases in place for a variety of reasons. These types of properties require the investor to continuously rent the unit or dwelling out to drive revenue. If you can’t find occupants for a few months or even just a few weeks, then there is no revenue, and this will affect your ability to pay back a loan.

If the Borrower is not the primary occupant, this is an added risk to a lender, and investment properties, specifically STRs, fall further down the priority list for payment when there is a financial crisis.

In 2018, Airbnb partnered with Fannie Mae and several financial institutions to make it possible for their hosts to use their Airbnb Proof of Income on their refinance applications. Proof of Income, not the market rent. There was no parallel change in the GSE policies to allow the use of STRs in the formation of an opinion of Market Rent.

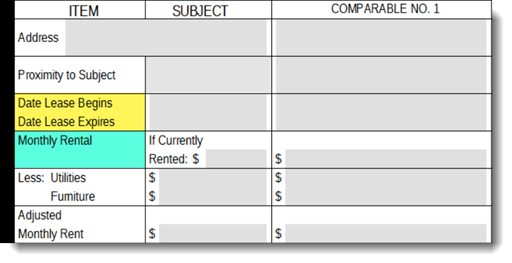

The best tool to determine an estimate for an STR is through AirDNA. https://www.airdna.co/

Most appraisers who are using STRs to opine on the market rent are performing a simple math equation (nightly stay as of a specific date multiplied by 365 days and divided by 12 months); if only it were that simple.

An STR represents a Going Concern Value which is most similar to the Market Value of a business operation which includes the assets of the business. Appraising the Going Concern Value is typically outside the scope of most residential appraisers. The STR is a business that competes with hotels and motels. Here are just a few considerations:

- Daily rates changes (weekends, seasonally, surrounding major events, etc)

- Vacancy rates (weekend vs mid-week, high season vs low season, etc)

- Management and Marketing costs

- Maintenance and Cleaning costs.

- Jurisdictional requirements.

Unless the appraiser has the data and analytical tools to support their opinion on these issues the opinion should not be provided. It should also be recognized that “Income” is only half of the income approach to value. The GRM data developed based on long-term rentals would not be compatible with STR income levels. The appraiser would be obliged to develop a 2nd STR GRM to avoid a misleading income analysis.

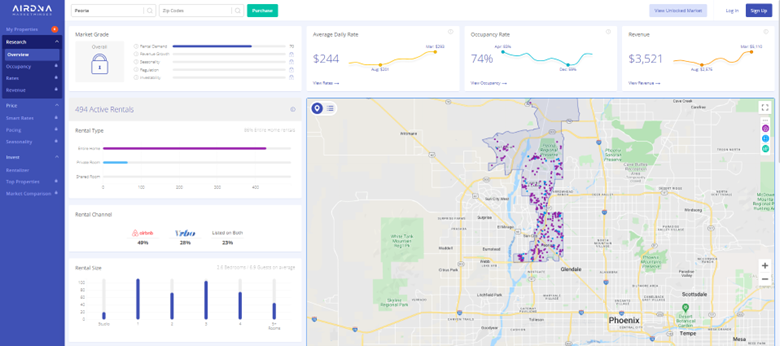

Per AirDNA (Peoria, AZ), the average STR is “rented” for $244 per night with a 26% vacancy rate and monthly revenue of $3,521.

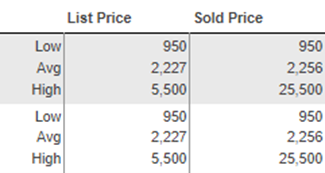

Per the Arizona Regional Multiple Listing Service (Peoria, AZ) the average home is “leased” for $2,256 per month. The spread is 35.9%.

Annualized, the difference is staggering; $41,252 vs $27, 072. So why wouldn’t every investor “rent” short-term instead of “leasing” long term? Uncertainty! The daily rate changes and could be lower by 17%. Vacancy rates can be higher and as much as 41%. There is significant management effort (entrepreneurial incentive) contributing to the income disparity, coordinating guests in and out of the unit, scheduling cleaning, scheduling repairs, and updates, etc. Lastly, the jurisdiction could change its position on STRs overnight putting the business out of business.

This is just one example of a state giving permission to its cities to limit STRs. The problem that these jurisdictions face when allowing the widespread use of STRs is those considered to be an unintended consequence, like the eviction of a tenant to take advantage of higher daily rents to travelers. Neighbors share concerns that their once tranquil neighborhood will become the next hotel district. The government also has its own concerns and that generally revolves around taxation.

Per Investopedia, the City of Santa Monica in California “has effectively wiped out 80% of its Airbnb listings by instituting the toughest regulations on short-term rentals in the U.S. The new regulations, which have been effective since June 2015, require anyone putting a listing on Airbnb in Santa Monica to live on the property during the renter’s stay, register for a business license, and collect a 14% occupancy tax from users that will be payable to the city. In 2019, the City of Santa Monica reached an agreement with Airbnb in which the company agreed to remove illegal short-term listings from its website. As of 2019, the city has only 351 short-term rental properties”. Today, AirDNA reports that the number has increased to more than 850 STRs with nearly 200 sharing a room or sharing the dwelling. 850 sounds like a lot but consider that Santa Monica is nine times larger than the City of Sedona, Arizona which has nearly 2,600 STRs.

In addition to state and city laws, Homeowner’s Associations are also implementing rules through CC&Rs (deed restrictions) that could also limit a property owner from using the dwelling as an STR.

The lender is looking for certainty and is generally risk-averse or at the very least risk-tolerant. Financing a loan on the income generated from an STR that could be non-existent tomorrow is a challenge for any lender to overcome.

Summary

There are appraisers providing an opinion of market rent based on STRs, most of their own volition, the remainder at the urging of the participants in the transaction. The state regulators who manage the appraiser’s license and are charged with enforcement are disciplining their respective appraisers for using STRs to determine the market rent.

When presented with a residential property that is being used as an STR, we can provide our opinion of the value of the real property, and we can even provide an opinion of market rent based on long-term leases (as noted in the form). This is not to suggest that an appraiser cannot provide their opinion of the Going Concern Value, but the appraiser needs to be competent in doing so, have access to data, and report it appropriately (which is not on the 1007 Single-Family Comparable Rent Schedule). Currently there is no GSE-approved form for reporting STR Market Rent. Alternatively, an appraiser would need to develop a USPAP compliant, credible opinion of STR Market Rent, and report it in a narrative format.